Who Pays for Adult Day Care?

Adult day care services are an important source of respite for caregivers and their loved ones, and cost coverage is available through various means.

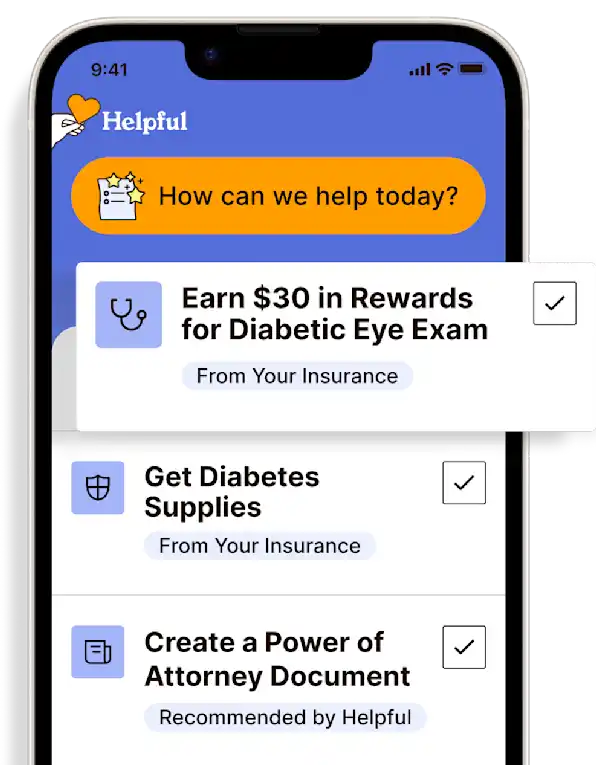

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Adult day services are divided into three types: (social) adult day care, adult day health (medical) care, and specialized adult day care.

Adult day services are paid for through various means, the largest of which are Medicaid/Medicaid Waiver and private pay (out-of-pocket).

Thorough descriptions and sources for further information on the various coverage programs are included.

Adult day services reimbursement programs

Medicaid and Medicaid Waivers

Program of All-Inclusive Care for the Elderly (PACE) & PASSPORT

Long-term care insurance (LTCI)

Managed long-term care plans (MLTC)

Senior services tax levies

Veterans Administration (VA)

Private pay

Medicaid & Medicaid Waivers

65% of the cost of adult day care is covered by Medicaid, which is intended to divert expenditure from expensive nursing homes to home- and community-based services (HCBS).

Medicaid pays for adult day care to contain its costs by helping families continue to care for loved ones at home. This reduces the number of nursing home admissions that are paid for (or will eventually be paid for) by Medicaid.

Medicaid is a collection of many different programs. Each state has its own rules regarding Medicaid benefits, and several different Medicaid programs, all of which have their own policies for adult day care coverage.

The state Medicaid program most likely to cover adult day care is Medicaid Waivers, which have several versions. Most states have Waivers that cover adult day care, and those that don’t offer alternative public funding for it. Some Waivers now allow states to offer long-term care Medicaid services outside of nursing homes to those who require a nursing home level of care but live at home. A major advantage of Waivers is that they almost always have higher monthly income limits than regular Medicaid programs, but the downside is that they have enrollment caps and there are waiting lists.

To a lesser extent, Medicaid state plans offer adult day care as a benefit. 15 states and Washington D.C. cover adult day care services via their state plan. The downside to state plans is that the monthly income limit for eligibility is very often lower than for Medicaid Waivers.

Regardless of the Medicaid program or waiver providing the adult day care benefit, all programs put limits on the amount a beneficiary can receive, and limits are typically dependent on the individual (the person-centered care plan). Always expect the maximum allowable to be 8 hours per day/5 days per week.

Contact your loved one's state Medicaid office for further information and guidance.

PACE & PASSPORT

Joint Medicare and Medicaid participants may be eligible to receive adult day health (medical) care from a local Program of All-Inclusive Care for the Elderly (PACE). These programs serve individuals who are 55 or older, certified by their state as needing nursing home-level care, able to live safely in the community at the time of enrollment, and living in a PACE service area. While all PACE participants must be certified to need nursing home care to enroll, 93% live in the community and get their daily care at a PACE adult day health care center.

Contact your loved one's PACE program or state Medicaid office for further information and guidance.

PASSPORT is for seniors aged 60 and older who need the level of care provided in a nursing home but want to stay in their home. It is a statewide program funded by Medicaid. Those who qualify for PASSPORT work with a nurse or social worker to develop a plan of care that customizes services to help them remain at home.

Area Agencies on Aging usually assist with PASSPORT qualification. Contact your Area on Aging for further information and guidance.

Long-term care insurance (LTCI)

Long-term care insurance is a popular option, but whether or not adult care services are covered will depend on the specific policy. Some policies cover only healthcare-related expenses at assisted living homes or nursing homes. Other policies are more generous and cover community-based care options.

For those plans offering coverage, it is for social or medical care in a day program in a licensed facility. Coverage varies depending on the plan and usually has an annual benefit cap. LTCI plans also have elimination periods, usually between 30-180 days, where expenses are out-of-pocket before insurance kicks in.

If your loved one has an LTCI policy, review the policy and/or contact the insurance company for available adult day services benefits.

Managed long-term care (MLTC)

Managed long-term care plans have (social) adult day and adult day health (medical) care benefits, which require prior authorization and continued approval, and usually have a daily max number of units or dollars and an annual cap.

Review your loved one's MLTC policy and/or contact the policy carrier for available adult day services benefits.

Senior levies

These are county-specific and determined by vote. They are local property tax levies that collectively fund senior services in that county. They offset costs such as non-emergency transportation, meal delivery, and respite care for seniors.

Contact the State Department of Aging or your County Tax Clerk's office to find out if there are senior services levies in your area and how to utilize them.

Veterans Administration (VA)

VA benefits will cover expenses associated with adult day health care for eligible seniors. To qualify, they must be eligible for community care and meet the clinical criteria for the service. In other words, a VA physician must indicate that adult day health care is needed. Older adults who qualify might need to pay a copay for adult day health care services. How much depends on income level and VA service-connected disability status.

In most cases, the VA will not cover adult day health care solely for social purposes or for caregiver respite costs. The main exception is if the Veteran’s Pension includes an Aid and Attendance benefit. This supplemental policy might cover social adult day care.

Call your loved one's VA Care Manager or the VA Caregiver Support Line (CSL) at (855) 260-3274 to learn more about the support that is available to you. Have your loved one's VA pension and supplemental policies information ready.

Family Caregiver Support Program (FCSP)

The Family Caregiver Support Program (FCSP) is a program that assists family caregivers who are taking care of elderly or disabled family members. This program is often administered at the state level and may vary in its specific offerings. It typically provides a range of supportive services to help family caregivers manage their caregiving responsibilities. These services may include information and assistance, counseling, respite care, and supplemental services.

FCSP provides grants to the states to support various programs that assist caregivers in caring for their loved ones at home for as long as possible. One of these programs is the Caregiver Respite Care program, which is funded by the U.S. Department of Health and Human Services Administration on Aging and typically administered locally by the Area Agencies on Aging network. Caregiver respite programs provide trained caregivers who attend to the individual in need of care to give the primary caregiver time to relax and attend to their own needs. Typically respite care occurs in the family home, but can occur in adult day care centers or overnight residential facilities, as well.

Contact the State Department of Aging for more information on what's available through the FCSP.

Private pay

Many older adults turn to retirement funds, savings, family contributions, and other forms of private payment to pay for adult day care.

Seniors without enough regular income or savings to afford adult day care might also take out a loan, secure a reverse home mortgage, or cash out on the value of a life insurance policy. Include family and a trusted financial advisor when deciding the best way to pay for the care.

*NOTE that adult day care costs are nearly always tax deductible. There are two options: include the cost as a medical expense and receive a medical expense deduction or claim the dependent care credit. The dependent care credit allows you to claim up to 35 percent of up to $3,000 of adult day care costs for one dependent or up to $6,000 for two dependents.

Keep in mind that the claim is for one deduction or the other only. Consult a financial advisor or tax professional for guidance on the most beneficial claim.

RESOURCES

Adult Day Care: An Important Long-Term Care Alternative & Potential Cost Saver (2013)

Congressional Research Service (CRS) – Who Pays for Long-Term Services and Supports?

Ellen, M.E., Demaio, P., Lange, A., & Wilson, M.G. (2017). Adult day center programs and their associated outcomes on clients, caregivers, and the health system: A scoping review. The Gerontologist, 57(6), e85-e94. DOI

Gaugler, J. E., Zarit, S. H., Townsend, A., Stephens, M. P., & Greene, R. (2003). Evaluating community-based programs for dementia caregivers: The cost implications of adult day services. Journal of Applied Gerontology, 22(1), 118-133. DOI

Medicaid.gov – Home and Community-Based Services (HCBS, 2023)

National PACE Association (NPA)

Oliver, R.E., & Foster, M. (2013). Adult day care: An important long-term care alternative & potential cost saver. Missouri Medicine, 110(3), 227-230. Link

Paying For Senior Care – Medicaid & Adult Day Care: State by State Benefits and Eligibility

U.S. Dept of Veterans Affairs – Geriatrics and Extended Care (2023)

Get more support and guidance on insurance benefits, medical records and legal forms.

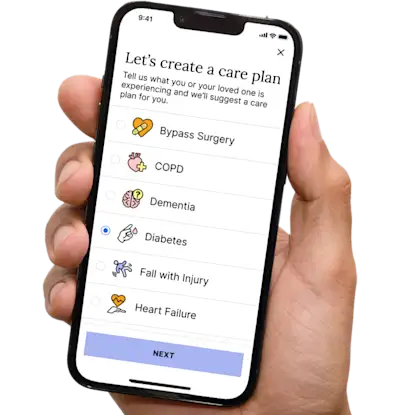

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.