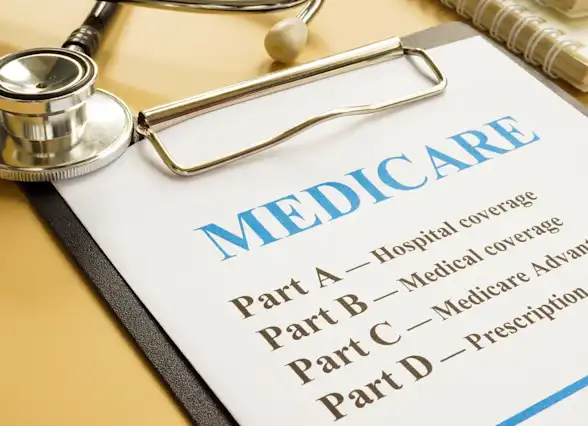

What's the Difference Between Medicare Parts A, B, C, & D?

Even people who already have Medicare may not know the difference between the parts or what services those parts cover.

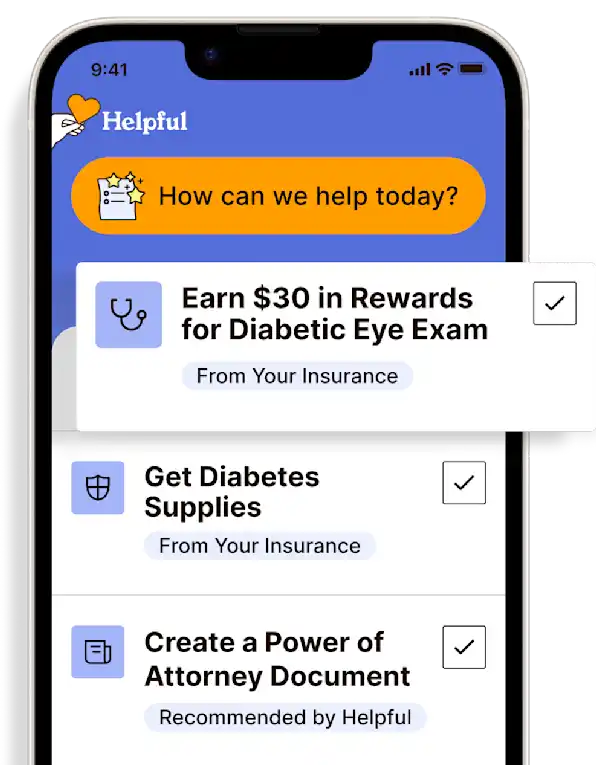

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Medicare has many parts and plans, the primary parts are A, B, C, and D.

There are also Medicare Supplement plans (commonly called "Medigap").

Original Medicare is considered to be Parts A & B, provided by the U.S. Government.

Medicare Part C is another term for Medicare Advantage plans (also called "MA" plans). This is different, but not entirely separate from, Original Medicare and is provided through private companies.

Medicare shouldn’t be complicated, but it kinda is!

It is important to understand Medicare plan choices and to pick coverage carefully. This can impact your loved one's out-of-pocket costs and where they can get their care.

Four parts: A, B, C, & D

Medicare Part A. This is the inpatient services and hospital fees benefit. It covers hospitalizations and the services provided while in the hospital. Hospital room and meals, nursing and physician care, supplies and medications, therapies, and diagnostic tests. Anything needed within the hospital for safe discharge. This benefit is free (no monthly premium) for those age 65 and older who have worked at least 40 taxed quarters in their lifetime (10 years). For those who do not meet this criteria, a monthly premium applies.

Medicare Part B. This is the outpatient services and medical care benefit. It covers services and therapies provided outside the hospital and medical care in the home, including some medications (those that are not self-administered). Everyone pays a monthly premium for Part B, which is currently $164.90, with a $226.00 annual deductible (2023 rates). Someone can opt out of Part B if they have credible medical insurance elsewhere, such as a commercial provider offered through a pension plan, though most do not choose to do this. Opting out is usually a matter of cost (savings) and not coverage.

Medicare Part C. This is another term for Medicare Advantage or "MA" plans. These are health insurance plans offered by private companies that have been approved by Medicare. There are hundreds, if not thousands, of MA plans available throughout the U.S. - meaning there are probably a dozen available in your loved one's area. In order to elect Part C, your loved one must first have Parts A & B. Once someone is part of an MA plan, premiums are paid directly to the insurance provider and not to Medicare. It is required that Part C plans offer the same benefits as Original Medicare Parts A & B, though Part C plans may charge higher premiums or copays/coinsurances for those benefits. With Part C, your loved one is not eligible for Medicare Supplement. See additional content: Original Medicare vs. Medicare Advantage Plans.

Medicare Part D. This is the prescription drug plan (PDP) benefit. It covers medications prescribed by a provider and dispensed through a pharmacy or pharmacy service (mail order). There are many Medicare Part D plans to choose from, so it's important to find the one that works best for your loved one. Be sure to check the plan's formulary, or list of approved drugs, as well as the pharmacy network. Medicare.gov has a simple tool to compare Part D plans. There is a monthly premium for Part D plans unless it is included with an MA plan (Part C), and they vary per location, deductible, and formulary (list of approved drugs). The national average is currently $32.74 per month (2023) plus a deductible. Note that with most MA plans, your loved one cannot choose their Part D plan - they must use the one provided.

Medicare Supplement ("Medigap")

This comprises ten letter plans, Plan A through Plan N (not all letters are represented). These are commonly called "Medigap" plans and cover part or all of the remaining 20% of healthcare costs that Original Medicare Parts A & B do not cover (they cover 80% of costs). There are monthly premiums for these plans and they vary by plan. A supplement is not available for those enrolled in Part C (Medicare Advantage plans). Note that Plan F is not available for anyone born after January 1, 1955. See additional content: Medicare: Supplement or "Medigap" Plans Explained.

RESOURCES

Medicare Program - General Information

Health Plans - General Information

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

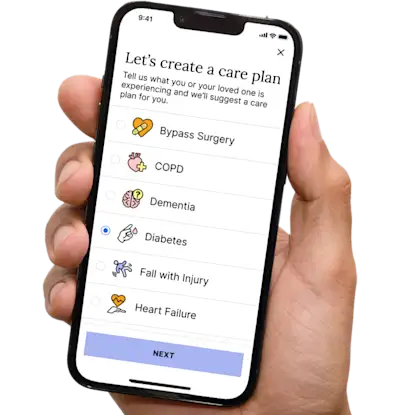

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.