Medicare Supplement or "Medigap" Plans Explained

Medicare Supplement plans (Medigap) are additional plans purchased to cover some or all of the costs not covered by Original Medicare (Parts A & B).

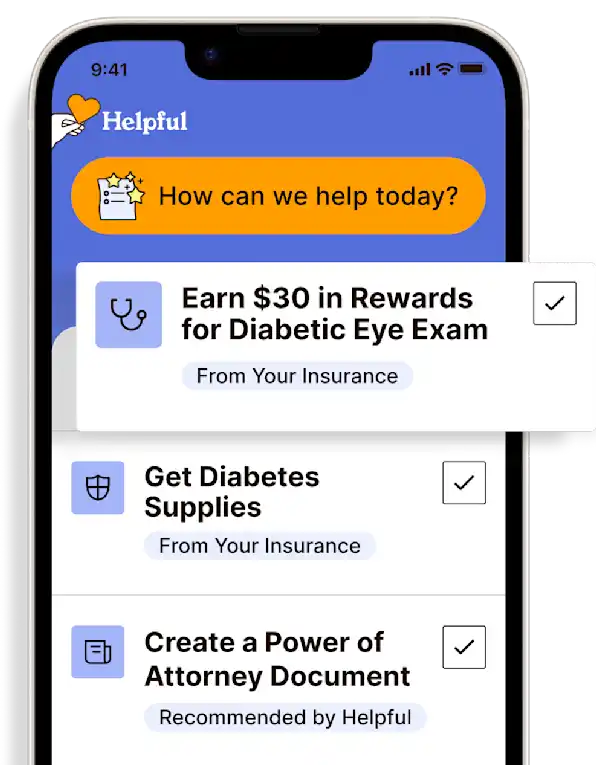

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Medicare does not provide Medigap plans, insurance companies do.

There are 10 letter plans to choose from; Plan A through Plan N (not every letter is represented).

Don't get confused... Medigap Plans A, B, C, and D are not the same as Medicare Parts A, B, C, and D.

Those with Medicare Part C (Medicare Advantage) are not eligible for Medigap.

Many insurance companies offer Medigap insurance. You’ll find many options in your loved one's state, from large, well-known carriers to smaller, underrated ones. A Medigap policy may be purchased from any insurance company that's licensed in your state to sell one.

Medigap policies include similar benefits with a few differences. To figure out which policy is needed, find the benefits that are most important to your loved one, then select the policy that most closely matches those needs.

According to Medigap.com, generally, the best plan options (aside from Plans F and C) are Plans G and N. Note that some states standardize plans in different ways, for example by featuring a base plan with riders that offer supplementary coverage. Likewise, some states limit Medigap premium prices.

Any standardized Medigap policy is guaranteed renewable, even if your loved one has health problems. This means the insurance company cannot cancel the Medigap policy, provided the premiums are paid.

Medigap policies can no longer be sold with drug coverage, but if your loved one has an older Medigap policy that was sold with drug coverage (before January 1, 2006), they can keep it. For those purchasing a Medigap plan after January 1, 2006, they will need to join a separate Medicare Part D prescription drug plan (PDP).

The best time to enroll in a Supplement policy is during the Initial Enrollment Period (IEP) or Special Enrollment Period (SEP). Remember that if your loved one has Medicare Part C (enrolled in a Medicare Advantage plan), they are not eligible for a Medigap policy.

Medigap plans do not offer any additional benefits, and they do not cover long-term care or private-duty nursing. They only cover costs that Original Medicare does not cover. Medigap is accepted by any provider or hospital that accepts Medicare.

Plan F

Plan F is not available to anyone born after January 1, 1955; however, if your loved one already has Plan F, they may keep it. Plan F is the most comprehensive plan and pays all out-of-pocket costs associated with Original Medicare. The only cost to the member is the monthly premium. No matter what the medical costs are, there are no copays, coinsurance, or deductibles.

Plan F - High deductible (HD-F)

Plan F also has a high-deductible version, wherein the deductible must be met before 100% coverage kicks in (this plan keeps the monthly premiums lower). The actual monthly premium depends on your loved one's age and resident state but runs between $30-$90.

Plan C

Plan C is not available to anyone who became eligible for Medicare after 2020. Plan C provides all the same coverage as Plan F, with the exception of Medicare Part B excess charges* that must be paid out-of-pocket.

*What are "excess charges"?

When the amount a health care provider is legally permitted to charge is higher than the Medicare-approved amount. The difference is called an excess charge.

Plan G

Plan G is the only other plan that covers Medicare Part B excess charges, though it does not cover the Medicare Part B deductible like Plans F and C do. The Part B deductible is paid out-of-pocket. Otherwise, Plan G offers all the same coverage as Plan F. Plan G is one of the two most popular plans (along with Plan N) outside of Plans F and C.

Plan G - High deductible (HD-G)

Plan G also has a high-deductible version, wherein the deductible must be met before 100% coverage kicks in (this plan keeps the monthly premiums lower). HD-G offers all the same coverage as Plan G (and subsequently, Plan F).

Plan D

Plan D is a lower premium plan and there are no copayments for office visits or the emergency room; however, like Plan N - it does not cover the Part B deductible or excess charges.

Plan N

Plan N is similar to Plan D but with copays. In exchange for a lower premium, members pay some of the costs, which include the Medicare Part B deductible, excess charges, and copayments for office visits and the emergency room.

Plans K, L, and M

Plan K. Plan K is the lowest-cost plan with the least amount of coverage. It does not cover the Part B deductible, excess charges, and pays half (50%) of the remaining Part A and Part B costs.

Plan L. Plan L is a low-cost plan with a moderate amount of coverage, more than Plan K. It does not cover the Part B deductible, excess charges, and pays 75% of the remaining Part A and Part B costs.

Plan M. Plan M is a deductible-sharing plan. It provides the same coverage as Plan N, but with greater out-of-pocket medical costs since it only covers half (50%) of the Part A deductible.

Plans A and B

Plan A. Plan A only covers basic benefits. It does not cover Part A or Part B deductibles, excess charges, or skilled nursing facility (SNF) coinsurance.

Plan B. Plan B provides the same basic coverage as Plan A, plus covers the Part A deductible.

A comparison chart of all 10 Medigap plans is also from Medigap.com.

RESOURCES

Medigap (Medicare Supplement Health Insurance)

What's Medicare Supplement Insurance (Medigap)?

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

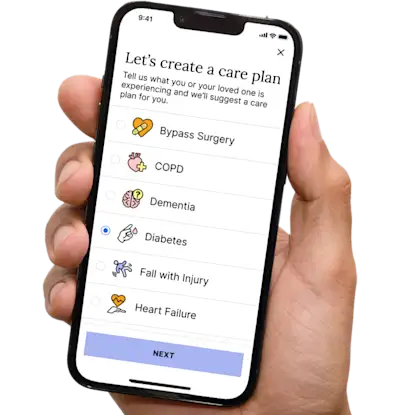

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.