Medicare Part D Prescription Drug Plan (PDP)

You hear the term "Part D" a lot, and you know it has something to do with prescription drugs, but what is it exactly?

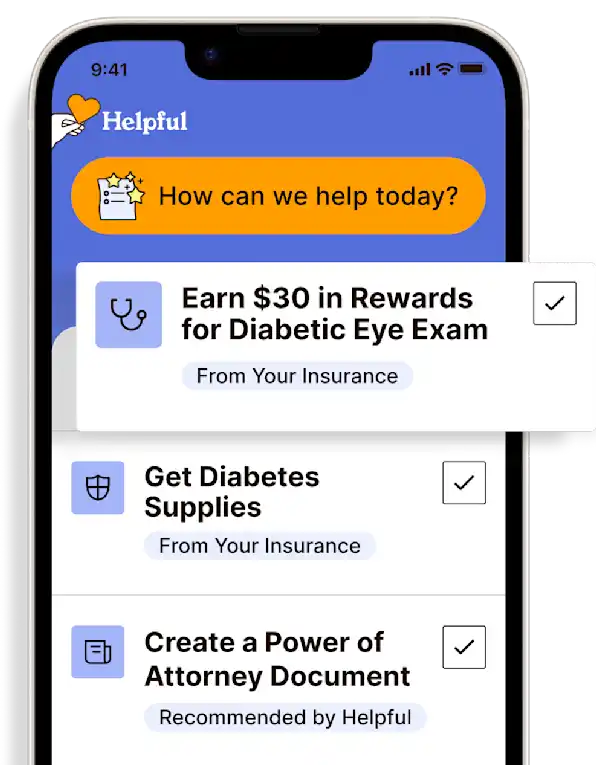

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Updated to reflect 2024 premiums and out-of-pocket costs.

Part D refers to a purchased prescription drug plan, and there are many to choose from.

Part D is required, or else Medicare applies penalties.

Part D is sold by private insurance companies, not by Medicare.

Part D is usually included in Part C (Medicare Advantage) plans.

What is Medicare Part D?

Medicare Part D, the prescription drug plan (PDP) benefit, covers most outpatient prescription drugs. Part D is offered through private insurance companies, either as a stand-alone plan for those enrolled in Original Medicare or as a benefit included with Medicare Advantage (Part C) plans.

Part D is optional and only provided through private insurance companies approved by the federal government. However, Part D is available to everyone who qualifies for Medicare. Costs and coverage may vary from plan to plan.

What is the value of Part D?

A Medicare Part D PDP is worth it for most people who do not have their drug coverage bundled into a Medicare Advantage plan. Medicare Part D makes prescription drugs more affordable, and basic coverage can be as little as $5 or $10 per month.

What is the average cost of Part D?

Medicare drug costs vary by plan. The national average premium for 2024 is $34.70 per month. People with high incomes have a higher Part D premium.

To find the best drug plan for you or your loved one, calculate the annual cost. The annual cost can be figured from their list of current drugs, the cost of the drugs from the pharmacies in their area, the monthly premium, and the annual deductible. Sometimes a higher monthly premium with a lower annual deductible, or a lower monthly premium with a higher annual deductible, will result in an overall lower annual cost. It is advisable to evaluate the drug plan every year, and drug plans change and there is no penalty to change drug plans during the Open Enrollment Period.

People cannot be denied enrollment in a Medicare Part D plan. These plans are guaranteed within a valid enrollment period. Pre-existing conditions will never affect Part D enrollment.

Do Part D premiums increase with age?

With an "Issue-Age Rated" plan, the premium is based on age at purchase or issuance and the policy. Generally, premiums are less when issued at a younger age, but premiums for these types of policies do not increase with age.

When should the member enroll?

Enroll at initial eligibility! Even if you or your loved one is not on medications now, they should still consider joining a Medicare PDP to avoid a penalty. It's likely that there is a plan that meets their needs with very low monthly premiums. Remember, they can always change drug plans during Open Enrollment.

Can Part D be added at any time?

The Open Enrollment Period is from October 15 - December 7 every year. During this time, the member can add, switch, or drop Part D coverage.

Can members get Part D if they only have Part A?

If they are eligible for Medicare coverage, they are also eligible for Medicare Part D. They must be enrolled in Part A and/or Part B to enroll in Part D. Though remember that Part D requires separate enrollment, as it is not automatic with Parts A & B.

What happens if they don't have Part D?

Upon receiving Medicare, if the member does not join a Part S plan, they will pay an extra 1% for each month (that's 12% a year) they are not in a Part D plan. Part D is required and this is the penalty for receiving Parts A & B without it.

Is the Part D penalty for life?

The 1% monthly (12% annual) penalty lasts for as long as the member lacks Part D coverage, and the amount is recalculated with each year's national base beneficiary premium. In other words, that 1% can result in an increased dollar amount year after year.

What is the Part D donut hole?

The Part D donut hole or coverage gap is the phase of Part D coverage after the initial coverage period. A person enters the donut hole when their total drug costs—including what they and their plan have paid for drugs—reach a certain limit. In 2024, that limit is $5,030. When they enter this coverage gap (donut hole) they are responsible for 25% of the cost of drugs. In all Part D plans, people enter catastrophic coverage after they reach $8,000 in out-of-pocket expenses for covered drugs.

RESOURCES

KFF - Changes to Medicare Part D in 2024 and 2025

Medicare - Costs for Drug Coverage

What You Need To Know About Part D Prescription Drug Plans

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

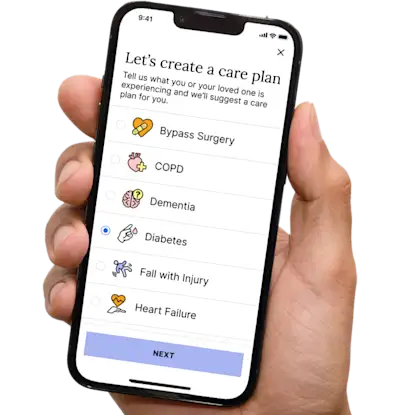

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.