Original Medicare (Parts A & B): Hospice Care

Covers care for those with a certified life expectancy of 6 months or less, who accept comfort care and sign a statement of choice.

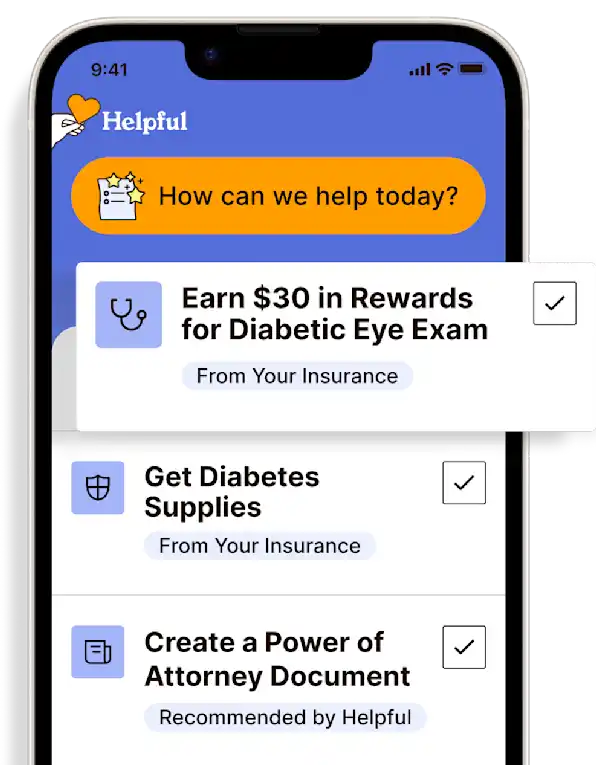

Access all my benefitsGet insurance benefits, legal documents, and medical records in one place

How To Receive

Details on how to apply

Obtain certification for terminal illness with a life expectancy of 6 months or less from your loved one's primary care provider or a hospice provider.

Elect hospice care by executing a signed statement.

Follow hospice care guidelines, as well as recommendations made by the hospice care team.

For more information on Medicare benefits and coverage, call 1-800-MEDICARE (1-800-633-4227) or visit the Medicare Benefits Website. TTY users, call 1-877-486-2048.

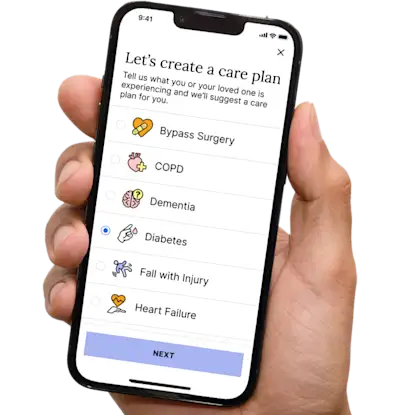

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

You or your loved one qualifies for hospice care if a primary care provider or a hospice provider certifies that they are terminally ill and have a life expectancy of 6 months or less. You or your loved one must also accept comfort care and symptom management instead of care to cure their illness. And you or your loved one must also sign a statement choosing hospice care instead of other Medicare-covered treatments for their terminal illness and related conditions (in other words, they must elect to have hospice care).

Medicare-certified hospice care can be received in the home or other facility where you or your loved one lives, like a nursing home. They can also receive hospice care in an inpatient facility, such as a long-term hospital.

What it is

Depending on the terminal illness and related conditions, the hospice team will create a plan of care that can include any or all of these services:

Provider services

Nursing and medical services

Durable medical equipment for pain relief and symptom management

Medical supplies (like bandages or catheters)

Drugs for pain and symptom management

Aide and homemaker services

Physical therapy services

Occupational therapy services

Speech-language pathology services

Social services

Dietary counseling

Spiritual and grief counseling for them, you, and other family

Short-term inpatient care for pain and symptom management

Inpatient respite care, which is care you or your loved one will get in a Medicare-approved facility (like an inpatient facility, hospital, or nursing home), so that you - their caregiver - can rest. The hospice provider will arrange this for you. The member can stay up to 5 days each respite care episode. While you can get respite care more than once, it will be limited to an occasional basis, as monitored by both the provider and Medicare.

Any other services Medicare covers to manage pain and other symptoms related to the terminal illness and related conditions, as the hospice team recommends.

Things to know

Only a primary care provider or a hospice provider can certify terminally illness with a life expectancy of 6 months or less. After 6 months, you or your loved one can continue to get hospice care in accordance with the following:

They can get hospice care for two 90-day benefit periods, followed by an unlimited number of 60-day benefit periods.

At the start of the first 90-day benefit period, their hospice doctor and regular doctor must certify that they are terminally ill (with a life expectancy of 6 months or less). At the start of each benefit period after the first 90-day period, the hospice medical director or other hospice provider must recertify that they are terminally ill, so they can continue to get hospice care.

Note that you or your loved one also has the ability to change their hospice provider once during each benefit period (if they feel a change in providers is needed).

Medicare won't cover any of these once the hospice benefit starts:

Treatment intended to cure the terminal illness and/or related conditions. Talk with the provider if you or your loved one starts thinking about getting treatment to cure their illness again. As a hospice patient, they do have the right to stop hospice care at any time.

Prescription drugs to cure or control the terminal illness. Drugs for symptom control or pain relief are covered, and you or your loved may remain on chronic condition maintenance medications, such as for blood pressure.

Care from any hospice provider that wasn't set up by the hospice medical team. You or your loved one must get hospice care from the hospice provider chosen. All care received for the terminal illness must be given by or arranged by the hospice team. You or your loved one can't get the same type of hospice care from a different hospice, unless they formally change their hospice provider. However, you or your loved one can still see their regular primary care provider if they have chosen him or her to be the attending medical professional who helps supervise the hospice care.

Room and board. Medicare doesn't cover room and board, whether at home or in a nursing home or inpatient hospice facility. If the hospice team determines that you or your loved one needs short-term inpatient or respite care services that they arrange, Medicare will cover that stay in the facility. The member may have a small copayment for respite.

Care received as a hospital outpatient (like an ER), care received as a hospital inpatient, or ambulance transportation. Unless these are either arranged by your hospice team or is unrelated to the terminal illness and related conditions (the member breaks a bone, for example).

Contact the hospice team before getting any of these services or you or your loved one might have to pay the entire cost.

Care for other conditions

The hospice benefit covers care for the terminal illness and related conditions. Once you or your loved one starts receiving hospice care, the hospice benefit should cover everything they need related to their terminal illness. The hospice benefit will cover these services even if they remain in a Medicare Advantage plan or other Medicare health plan.

After the hospice benefit starts, the member can still get covered services for conditions not related to their terminal illness. Original Medicare will pay for covered services for any health problems that aren’t part of the terminal illness and related conditions. However, the member must pay the deductible and coinsurance amounts for all Medicare-covered services received to treat health problems that aren’t part of the terminal illness and related conditions.

Medicare Advantage plan or other Medicare health plan

Once the hospice benefit starts, Original Medicare will cover everything needed related to the terminal illness. Original Medicare will cover these services even if the member chooses to remain in a Medicare Advantage plan or other Medicare health plan. If they were in a Medicare Advantage plan before starting hospice care, they can stay in that plan, as long as they continue to pay the plan premiums. When they get hospice care, the Medicare Advantage plan can still cover services that aren't a part of the terminal illness or any conditions related to your terminal illness.

If the member stays in their Medicare Advantage plan, they can choose to get services not related to their terminal illness from either network providers or other Medicare providers.

If you or your loved one chooses to leave hospice care, their Medicare Advantage plan coverage won't start again until the first of the following month.

Stopping hospice care

If you or your loved one's health improves or the terminal illness goes into remission, they may no longer need hospice care. They always have the right to stop hospice care at any time. If they choose to stop hospice care, they will be asked to sign a form that includes the date hospice care will end.

TIP: They shouldn’t be asked to sign any forms about stopping hospice care at the time they start hospice. Stopping hospice care is a choice only they can make, and they shouldn't sign or date any forms until the actual date that they want their hospice care to stop.

If you or your loved one was in a Medicare Advantage plan when they started hospice, they can stay in that plan by continuing to pay the plan premiums. If they stop hospice care, they are still a member of the plan and can get Medicare coverage from the plan after they stop hospice care. If they weren’t in a Medicare Advantage plan when they started hospice care, and decide to stop hospice care, they can continue in Original Medicare.

If eligible, you or your loved one can return to hospice care at any time.

Costs

You or your loved one pays nothing for hospice care.

Up to $5 for each prescription drug for pain and symptom management.

The hospice provider will contact the member's Part D plan in the case that the hospice benefit doesn't cover the ordered drug.

The hospice provider will inform you and your loved one if any drugs or services aren't covered and the out-of-pocket costs associated.

(Maybe) 5% of the Medicare-approved amount for inpatient respite care, though the copay cannot exceed the inpatient hospital deductible for the year ($1,600).

Room and board if you or your loved one live in a facility like a nursing home and chooses to get hospice care.

Up to 20% copay for Medicare-covered benefits received for any health problems that aren't part of the terminal illness and related conditions.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.