Defining Wills and Trusts

Wills and trusts are both documented legal arrangements centered on estate planning to manage your loved one's assets during life and after death.

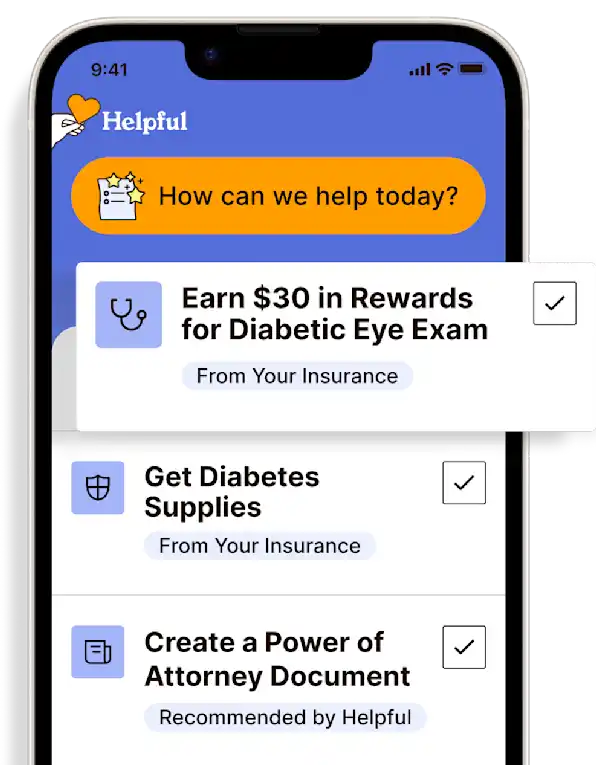

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

A will outlines how a person's assets and property should be distributed upon death.

A trust manages and distributes your loved one's assets according to their wishes while alive (with provisions for after death).

A will goes through the probate process where outstanding debts are considered first, whereas a trust is exempt from probate (in most cases) and beneficiaries are considered first.

A will has an executor, a trust has a trustee. The roles and responsibilities overlap though have a few important distinctions.

Last will and testament, or simply "will"

A last will, commonly referred to simply as a "will," is a legal document that outlines how a person's assets and property should be distributed upon their death.

It is one of the foundational documents in estate planning and a crucial tool for your loved one to express their wishes regarding the distribution of their assets, the care of their dependents (if any), and other important matters after their death. Key features include:

Distribution of assets.* A will allows your loved one, referred to as the testator, to specify who will receive their assets and property after their death (beneficiaries). This includes real estate, money, investments, personal belongings, and any other assets they own.

Appointment of an executor. A will typically appoints an executor, also known as a personal representative or administrator, who is responsible for carrying out the instructions outlined in the will. The executor's duties may include gathering assets, paying debts and taxes, and distributing inheritances to beneficiaries. The executor may also be a beneficiary.

Guardianship provisions. If your loved one has minor children or adults requiring guardianship due to special needs, a will can designate guardians to care for them in the event of your loved one's death. This is an important aspect of estate planning to ensure the well-being of minor children and persons with special needs and the continuity of their care.

Funeral and burial wishes. A will may include instructions regarding your loved one's funeral and burial preferences, such as whether they wish to be buried or cremated, and any specific arrangements they desire.

Residual clause. A residual clause, also known as a residuary clause, is a provision in the will that addresses the distribution of assets not specifically mentioned in the document. It ensures that any remaining assets are distributed according to your loved one's overall estate plan.

Legal formalities. To be legally valid, a last will must comply with certain formalities established by state law. These may include requirements related to your loved one's mental capacity, the presence of witnesses, and the proper signing and witnessing of the document.

*It's important to note that a will typically goes through the probate process, which can be time-consuming and costly. As such, individuals may also consider other estate planning strategies, such as trusts, to achieve their objectives effectively.

Living trust, or simply "trust"

A trust is also one of the foundational documents in estate planning and is used to manage and distribute assets according to your loved one's wishes. Many important characteristics distinguish a trust from a will, namely that a trust manages assets while your loved one is still alive and does not go through the probate process.

In general, a trust is a legal arrangement where your loved one transfers ownership of assets to another party, known as the trustee, to manage those assets for the benefit of one or more beneficiaries. Key elements include:

Settlor. The settlor is your loved one - the individual who creates the trust and transfers assets into it (known as "funding" the trust). The settlor defines the terms of the trust, including which assets are included, how they should be managed, and designates the beneficiaries.

Trustee. The trustee is comparable to the executor of a will, though functions are slightly different. The trustee, which can be an individual or entity, is responsible for managing the trust assets and carrying out the instructions outlined in the trust document. The trustee has a fiduciary duty to act in the best interests of the beneficiaries and to administer the trust according to the terms set forth by the settlor. It is quite common for the trustee to also be a beneficiary.

Beneficiaries. Beneficiaries are the individuals or entities who are entitled to receive benefits from the trust. They may receive income generated by the trust assets, distributions of principal (the assets entered into the trust), or other benefits as specified in the trust document. Beneficiaries can include family members, charities, or even other trusts.

Trust assets. Trust assets are the property, investments, holdings, cash, or other assets that are transferred into the trust by your loved one. These assets are held and managed by the trustee for the benefit of the beneficiaries. Trust assets can include real estate, stocks, bonds, bank accounts, business interests, and personal property.

Trust document. The trust document, also known as the trust instrument or trust agreement, is a legal document that outlines the terms and conditions of the trust. It specifies the powers and duties of the trustee, the rights of the beneficiaries, and the distribution of assets. The trust document is created by your loved one and is typically drafted with the assistance of an attorney (though this is not mandatory).

There are different types of trusts available, each with its own characteristics and benefits, depending on your loved one's goals and objectives.

Points of interest

Your loved one can have either or both a will and a trust, and having both is common in estate planning. For more information on the difference between them and which may be better for your loved one, see our Guide: Should We Get a Will or A Trust? What's the Difference?

A will alone may be sufficient, especially if your loved one's estate is relatively simple. The more complex the estate (i.e., the more assets), the more likely a trust is to serve them better due to its flexibility, time savings, and wealth protection.

Trusts can serve various purposes in estate planning that wills cannot, including avoiding probate, funding other trusts (for minor children or individuals with special needs, for example), minimizing estate taxes, protecting assets from creditors, and preserving wealth for future generations.

Probate is the legal process through which a court validates a will, settles any outstanding debts and taxes owed by the deceased, and oversees the distribution of assets to beneficiaries according to the terms of the will. While probate serves an important purpose in ensuring that a deceased person's assets are distributed correctly, several aspects of probate can make it undesirable for those with complex estates.

RESOURCES

No content in this app, regardless of date, should ever be used as a substitute for any direct legal advice you receive from your lawyer or other qualified legal professionals.

Get more support and guidance on insurance benefits, medical records and legal forms.

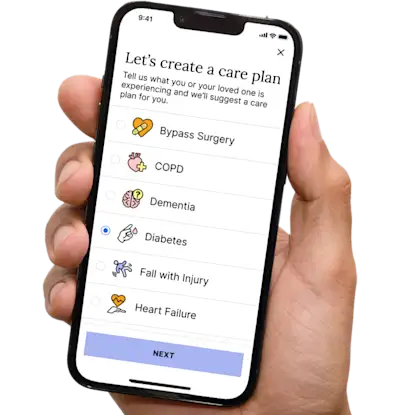

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.