Caregiving Challenges, Who Pays for Long-Term Care?

Most long-term care is paid for by your loved one or you, though there are other sources of coverage to know about.

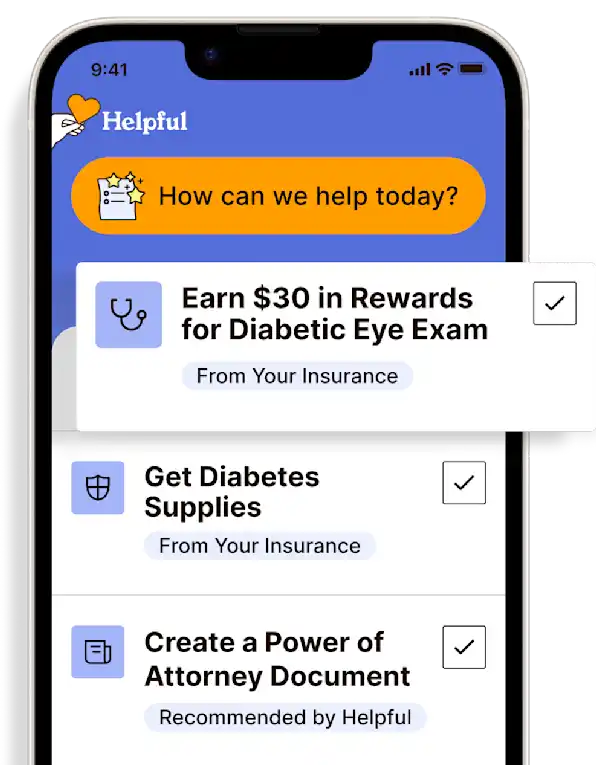

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Long-term care comprises home care, home health care, and nursing home care. If you are caregiving for a loved one, you are already providing long-term care (albeit unpaid).

There are many payor sources for your loved one's long-term care, and they may have more than one. Each is discussed below.

Medicare does not pay for long-term care.

The least understood and underutilized of the payor sources is long-term care insurance or LTCI (not discussed here, see What to Do with Long-Term Care Insurance).

"When many families begin their caregiving journeys, they are unaware that Medicare does not pay for LTSS and that Medicaid—an important safety net program—only covers the cost of healthcare and LTSS when older adults have exhausted their resources. Relatively few people have private long-term-care insurance, or have a clear understanding of the potential costs of LTSS."

In addition to personal finances, other sources of long-term care coverage include Medicare Advantage, Medicaid (Medical Assistance), Veterans Administration (VA), and private/commercial insurance.

Private Individuals/Personal Finances

Many individuals who require extensive long-term care eventually spend down their savings and other financial resources and eventually qualify for Medicaid (see below).

Long Term Care Insurance (LTCI)

See What to Do with Long-Term Care Insurance (LTCI) content.

Medicare

Medicare does not cover long-term care services or coverage over extended periods of time. It provides limited coverage for short periods of time for nursing home and home health care.

Medicare Supplement Insurance

Medicare supplement insurance also does not provide coverage for long-term care. Supplements are designed to layer in with Medicare benefits and usually cover the co-pays for Medicare-approved services (formerly referred to as "Medi-Gap").

Medicare Advantage

Medicare Advantage benefits may offer some limited long-term care coverage. Every plan is different, so check the plan benefits that are available and talk with a member services specialist.

Medicaid

Medicaid plans are government health care programs provided through state and federal funding.

If eligible, Medicaid will pay for most health care costs, including nursing home and community-based care (including in-home care). However, long-term personal care (such as in-home assistance with activities of daily living or safety supervision) is likely not covered.

VA Benefits

VA benefits are authorized through the Veterans Administration clinics and/or the VA Home and Community Department. There may be some long-term care coverage available. Contact the VA regarding coverage.

Services defined as "long-term care"

Nursing Home Care

Private Pay. The person or family pays for the cost of extended care.

Medicare. If a nursing home stay is approved by Medicare, then Medicare pays in full for up to 20 days of skilled nursing care in a Medicare-approved skilled nursing facility (SNF). However, Medicare will pay for the stay only if it follows a hospitalization of at least three days and you enter a Medicare-certified nursing home within 30 days after hospital discharge. For days 21-100, Medicare pays part of the cost of the stay, which must still be approved by Medicare. Medicare pays nothing beyond the 100th day. Also, note that Medicare narrowly defines skilled care (reducing the likelihood of approving stays and services).

Medicare Advantage. Medicare Advantage is required to provide at least what traditional Medicare provides, though it may cover more. Note that co-pays may be different. Check the plan benefits and speak with a member services specialist.

Medicaid. Medicaid is a major source of payment for nursing home care. To qualify for Medicaid nursing home benefits, medical, nursing, and/or therapeutic care must be required daily, as well as a doctor’s plan of treatment in place. If eligible for Medicaid, income must predominantly be used to pay nursing home bills, with Medicaid paying the remaining costs. When first admitted, many residents of nursing homes can pay for care themselves. Over the course of a long nursing home stay, however, many people use most of their savings to pay for that care and then become eligible for Medicaid upon reaching a low financial threshold.

VA Benefits. Contact the VA for authorized coverage.

Home Health Care

Medicare. Covers only those home health care visits that Medicare considers to be medically necessary. Medically necessary care is narrowly defined, and certain other criteria must be met before Medicare will pay for home health. For example:

The care must include intermittent skilled nursing care, physical therapy, or speech therapy;

The recipient must be homebound;

A doctor must set up a home health care plan; and

The agency providing services must participate in Medicare.

Most personal care visits do not meet Medicare’s definition of medically necessary care. Therefore, Medicare will not pay for them.

Home health aide hours are limited, regardless, and must satisfy goals established by the home health care plan.

Medicare Advantage. Coverage is at least what is provided by Medicare, though services must be received from an in-network agency. Personal care coverage may be more generous under Medicare Advantage, though each plan is different. Check the plan benefits and speak with a member services specialist.

Medicaid. May pay for services received in the home. A doctor’s plan of care is required, the recipient must have medical needs that can be met in the home, and services must be from a home healthcare agency certified by Medicaid.

VA Benefits. Will usually authorize home health care services. Contact the VA for criteria and coverage.

Personal Care

Private pay. Assistance with activities of daily living and other services (homemaking, companionship, transportation) is paid for with personal finances.

Medicare. Does not cover personal care services except as associated with home health care.

Medicare Advantage. May offer some personal care coverage. Every plan is different, so check the plan benefits that are available and talk with a member services specialist.

Medicaid. Also pays for personal care, such as assistance with bathing, dressing, eating, or getting in and out of bed (activities of daily living). To be paid by Medicaid, a doctor’s plan of care is required and services must be from an agency certified by Medicaid. There may also be coverage for a limited amount of household help, such as grocery shopping, meal preparation, or laundry.

VA benefits. May offer some personal care and homemaking services approval through the VA Aid & Attendance benefit. Contact the VA for available coverage.

RESOURCES

Eisenberg, R. (2016, May 10). Americans' estimates of long-term care costs are wildly off. Forbes. Link

Feinberg, L.F., & Spillman, B.C. (2019). Shifts in family caregiving--And a grown care gap. Generations, 43(1), 73-77. Link

Gordon, D. (2022, August 02). Most Americans are unprepared for long-term care costs, new research shows. Forbes. Link

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

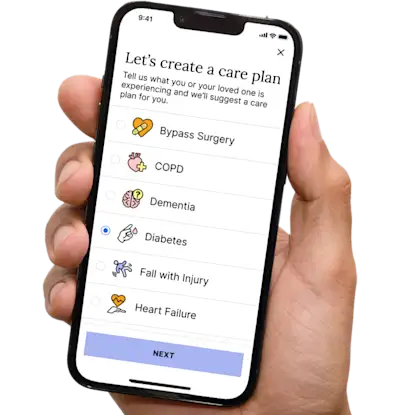

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.