Caregiving Challenges, What to Do with Long-Term Care Insurance (LTCI)

So, you find out that your loved one has long term care insurance (LTCI), what does that mean and what does it do?

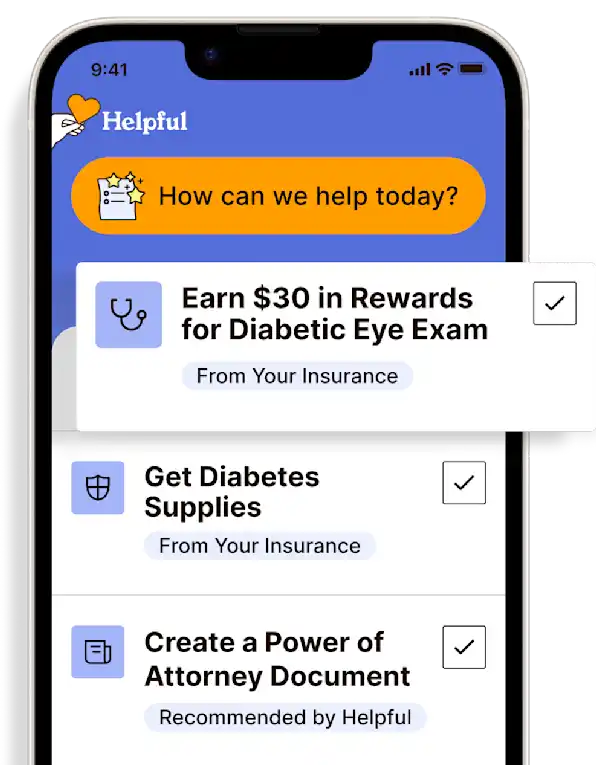

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Long-term care insurance (LTCI) has important financial advantages. Find out if your loved one has a policy.

Make sure you connect with someone who can help you understand the details of the policy, as insurance documents can be hard to interpret.

Get help with when and how to use LTCI to get the maximum benefits for your loved one. Inquire with advisors, your loved one's healthcare team, and facility administrators (if applicable).

Bottom line... If your loved one has long-term care insurance (LTCI), it will provide some coverage for the costs associated with the extended care required due to aging or a progressing chronic illness.

Best first step, read the policy

Get a copy of the policy and read through the entire document.

Look for reimbursement rates.

Is it per day (for example, $120/day)?

Is it associated with hours of service provided (for example, 4 hours/day up to 20 hours/week)?

Is there a lifetime maximum amount? What is it (example: $500,000 max or $1 million max)?

Is there an elimination (waiting) period? (This is an amount of time that must pass after the benefit trigger occurs but before payment for services is started. During this time, you must pay for care until the LTCI kicks in.)

Understand what initiates (triggers) the policy benefits.

Normally, the insured person must need assistance with 2 or 3 activities of daily living (ADLs). In most cases, this is determined by RN assessment (who is employed by or contracted with the LTCI company).

Does a change in residence to an assisted living facility (ALF) or nursing home qualify? (Sometimes a per-day reimbursement will be part of the policy in this circumstance.)

Does the LTCI policy have requirements regarding who can provide care? (Some require care to be provided by a licensed home care agency.)

Will the LTCI policy allow assignment of benefits (AOB)?

AOB means the agency is given permission to bill and receive payment directly. Without an AOB in place, you will have to pay for the services, and then file a claim for reimbursement.

Contact the insurance company if you have questions.

Key point

If there is a maximum lifetime dollar limit on the policy, try to figure out how long the policy will cover care based on the number of hours of care needed (in other words, how long until the money runs out). This will help you determine when and how to use the benefits. LTCI agents, as well as specialists in aging like geriatric care managers, Certified Life Care Planners, or Certified Senior Advisers (CSA), can help you with this.

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

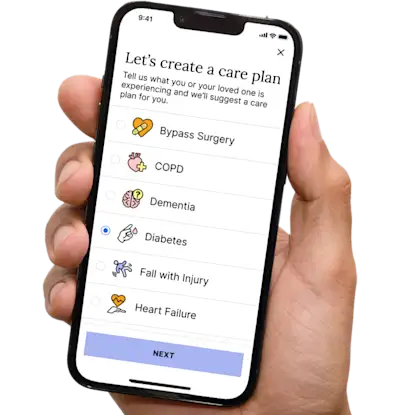

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.