Safeguarding Against Scammers and Predatory Marketers

As caregivers, one of our essential roles is to protect our aging loved ones from those who might exploit their vulnerability.

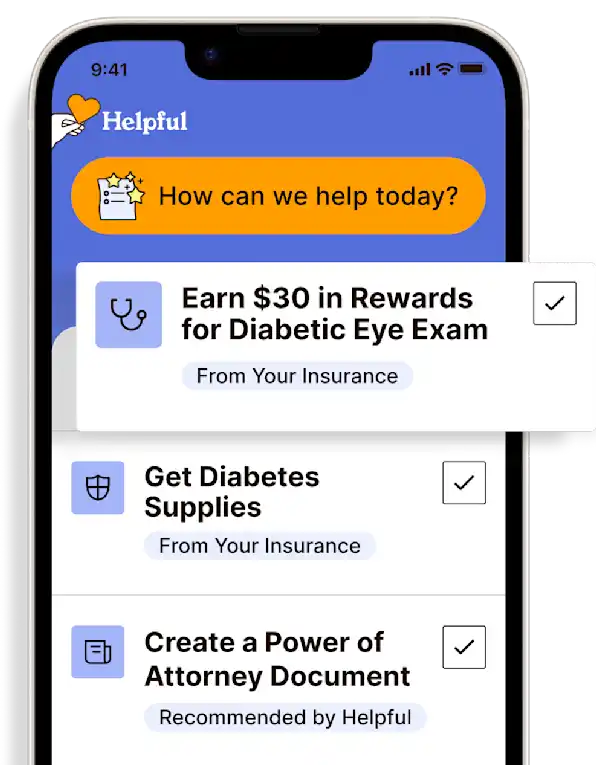

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

Learn to recognize common scamming tactics, and talk with your loved one about legitimate versus illegitimate marketing.

Discuss appropriate and responsible technology use with your loved one, including signals of scamming.

Remember to thoroughly vet service providers and monitor finances closely.

Unfortunately, many scammers and aggressive marketers specifically target seniors, using sophisticated ploys designed to gain their trust and access their finances. Here are crucial tips and examples of common tactics to help caregivers recognize and prevent these dangerous situations.

Recognize common scamming tactics

High-pressure sales and scare tactics. Scammers often create a sense of urgency to pressure the elderly into making hasty decisions. For example, they might claim that a special offer is only available for a limited time, or assert that your loved one's financial security is in immediate jeopardy unless they act quickly.

Phishing attempts. These involve attempts to extract personal information under false pretenses. Scammers may send emails, texts, or calls posing as banks or government agencies (especially Social Security), asking for sensitive information to "verify" an account or resolve some supposed issue.

Fake charity scams. Especially after natural disasters or during holiday seasons, scammers will often solicit donations from non-existent charitable organizations. They exploit your loved one's generosity and empathy, using emotionally charged narratives to elicit financial contributions.

Monitor financial activities closely

Be vigilant about any unusual activity in bank accounts or on credit statements. Quickly identifying unauthorized transactions can be the first step in mitigating damage. Consider setting up transaction alerts with financial institutions to monitor any unexpected activity.

Thoroughly check service providers

Verify the provider's credentials and reputation before agreeing to any services, whether home repair, healthcare, or legal advice. Scammers often offer these services without proper qualifications, using this to enter homes or gain personal information.

Educate about responsible technology use

Introduce and maintain reliable security software to defend against malware and phishing. Instruct your loved one to set robust passwords and discuss the dangers of sharing information online. For example, explain why they should never click on unfamiliar links or respond to unsolicited requests for information.

Maintain open lines of communication

Encourage your loved one to share their interactions and transactions with you, especially if they involve financial decisions. Open communication helps to identify potential scams quickly and prevents isolation, which scammers exploit to manipulate their targets.

By implementing these strategies, you can significantly reduce the risk of financial or emotional harm to your loved one from scammers and aggressive marketers. Awareness and proactive prevention are crucial in providing a safe and supportive environment for the older adults in your family.

Get more support and guidance on insurance benefits, medical records and legal forms.

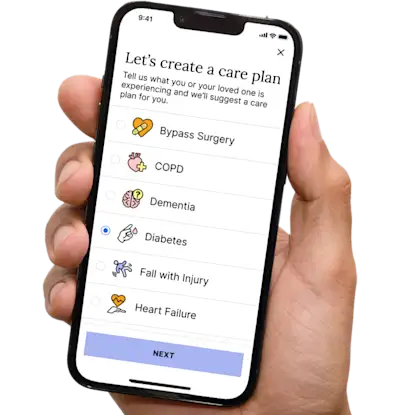

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.