Original Medicare vs. Medicare Advantage Plans

The decision whether to go with a Medicare Advantage (MA) plan or stay with Original Medicare (Parts A & B) can be challenging.

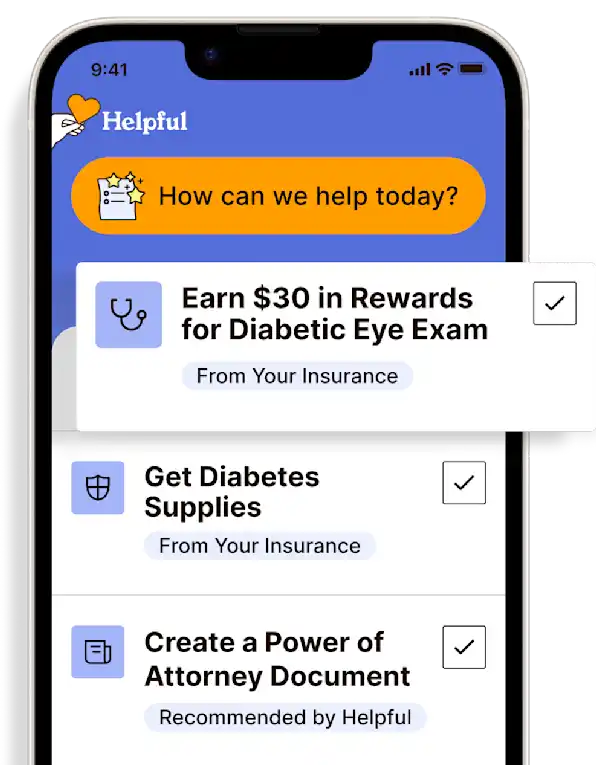

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

When deciding if Original Medicare or a Medicare Advantage (MA) plan is best, consult with a licensed independent insurance broker.

There are many parts to Original Medicare and Medicare Advantage (MA) plans, making them both less than simple to understand.

Medicare Supplement plans (Medigap) are only available with Original Medicare.

One is not necessarily "better" than the other and depends greatly on the person, their health status, and what they care about most (cost or coverage).

Understanding Original Medicare coverage compared with Medicare Advantage plans can be complicated. For most, it is more a matter of cost than coverage, though ultimately the right choice is the one that offers the best chance of remaining independent, safe, and well wherever your loved one calls home.

Licensed independent insurance brokers

We highly recommend that if you or your loved one are interested in exploring Medigap plans, you contact a licensed independent insurance broker who specializes in Medicare, Medicare Advantage, and Medicare Supplement for a discussion on all the options.

They work with you to narrow down the plan choices and find the best fit.

They do not work to increase sales and membership of any one insurance provider.

The services of a licensed independent insurance broker are free to you.

Medicare vs. MA: Comparison, advantages

Original Medicare (Parts A & B + Supplement)

Covered for any provider and hospital in the country that accepts Medicare.

Direct to any provider or hospital when care is needed, no prior authorization is required from Medicare or your loved one's primary care provider.

There are limits on the amounts that providers and hospitals can charge for care.

With Supplement plans, there is 50%, 75%, or 100% coverage after meeting the Plan B deductible ($226.00 in 2023).

Medicare Advantage (Part C, or MA plan)

Often includes a drug plan with no separate cost (deductibles still apply).

Frequently provides additional benefits that Original Medicare does not, such as routine vision or dental care and transportation.

Offers a care team, overseen by a dedicated Care Manager, to help with any questions or concerns about the plan and its benefits.

Medicare vs. MA: Comparison, disadvantages

Original Medicare (Parts A & B + Supplement)

Covers 80% of service fees if no Supplement ("Medigap") plan is purchased. Your loved one is then responsible for the remaining 20%.

To avoid paying some or all of that 20% out-of-pocket, your loved one can purchase a Supplement plan.

Supplement plans are not offered through Medicare. They are purchased from insurance carriers authorized by Medicare to sell them.

Likewise, a stand-alone Medicare private drug plan (PDP, or Part D) is required.

For healthy individuals (no progressive illness or chronic disease), it can cost more on an annual basis than an MA plan.

Medicare Advantage (Part C, or MA plan)

Plans have network restrictions, meaning that your loved one will be limited in their choice of providers and hospitals.

Also, even if the hospital is in-network, the providers that treat your loved one while there may not be in-network.

A referral from their primary care provider is required to see any specialists, and oftentimes prior authorization from the plan is required.

Plan offerings can be more complex than Original Medicare, namely because of prior authorization and referral requirements, and delays in seeing specialists or getting medical testing and treatments may occur because of these requirements.

There are copays or coinsurances for most services, hospitalizations, provider visits, lab work, and diagnostic testing. Plans will not pay 100% of costs until the $8,300 annual (2023) maximum out-of-pocket (MOOP) is met.

In most types of Medicare Advantage plans, members may not choose their own Part D (prescription drug) plan. They must use the one provided by the Medicare Advantage plan, even if it's not the best one for them.

Some coverage is state-specific (important if your loved one moves to another state).

In the event of a health crisis, it can cost more than Original Medicare.

Drug Plans (Part D)

Required by all plans.

Part D is usually included in Medicare Part C plans, though if not included, is still required.

If enrolled in a Medicare Advantage plan, the member must use the Part D plan included. They cannot choose another Part D plan.

Costs can vary per location, deductible, and formulary (list of approved drugs).

What is Medicare Supplement (Medigap)?

Offered by insurance companies, not Medicare.

Provides additional coverage for the remaining 20% that Medicare Parts A & B do not pay.

Ten letter plans available, Plan A through Plan N (not all letters are represented). Note that Plan F is not available for people born after January 1, 1955, and Plan C is only available for people who became eligible for Medicare before January 1, 2020.

Not available with Part C (MA plan).

For details on these plans, see additional content: Medicare: Supplement or "Medigap" Plans Explained.

To start comparing your loved one's current coverage with other options (i.e., comparing MA plans available in their area), visit Medicare.gov/plan-compare.

It is because of the complexity involved in these decisions that connecting with an independent licensed insurance broker can help.

RESOURCES

Compare Original Medicare & Medicare Advantage

Understanding Medicare Advantage Plans

Original Medicare Versus Medicare Advantage

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

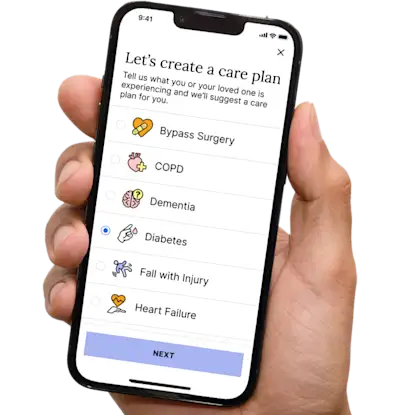

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.