Medicare Enrollment Periods

Medicare enrollment can be an inundating and confusing process, whether it is during an initial, open, special, or general enrollment period.

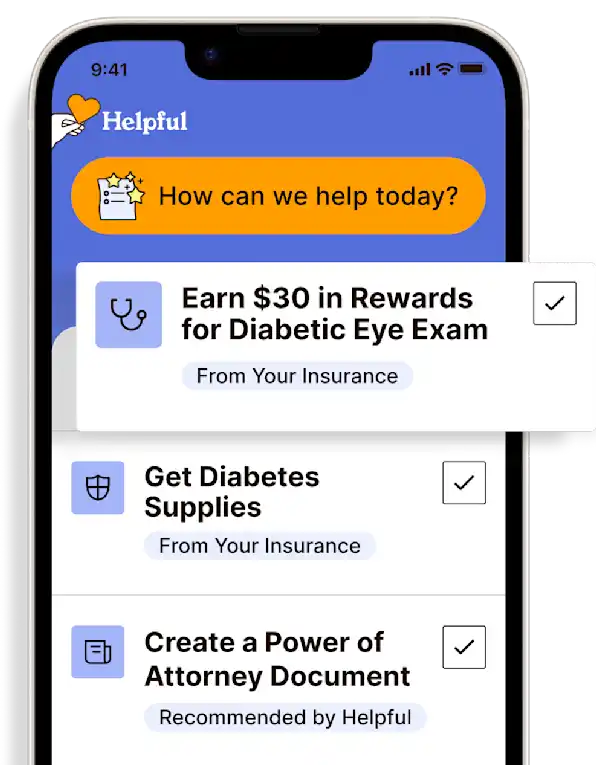

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

There are four enrollment periods for Medicare: Initial (IEP), Special (SEP), Open (OEP), and General (GEP).

People are guaranteed Supplement (Medigap) eligibility only during Initial and Special Enrollment periods.

Open Enrollment occurs in the last quarter of every year (October 15 - December 7) and plan changes can be made at that time.

General Enrollment occurs in the first quarter of every year (January 1 - March 31) and has very specific criteria.

Six months before your loved one's 65th birthday, their mailbox will be filled with letters, pamphlets, invitations, and more information than either of you can ever read. Your loved one may even receive electronic communications. And every year thereafter, during Open Enrollment, they will be bombarded with this information again.

Beware of Medicare enrollment phone calls. Medicare advisors or plan representatives will never call your loved one unless they are already enrolled (renewal calls).

Initial Enrollment Period (IEP)

Your loved one has a 7-month window to join Medicare – from 3 months before the month they turn 65, through their birthday month, and 3 months after the month they turn 65.

So, if their birthday is in November, they will have August-October (age 64), November (birthday month), and December-February (now age 65) to enroll.

Special Enrollment Period (SEP)

After the Initial Enrollment Period is over, your loved one may have a chance to sign up for Medicare during a Special Enrollment Period. For example, if they didn't sign up for Part B (or Part A if they must buy it) when they were first eligible because they had group health plan coverage based on current employment, they can sign up for Part A and/or Part B:

Any time they are still covered by the group health plan.

During the 8-month period that begins the month after employment ends or the coverage ends, whichever happens first.

Coverage starts the first day of the month after they sign up. Usually, they won't have to pay a late enrollment penalty if they sign up during a Special Enrollment Period. This period doesn't apply if they're eligible for Medicare based on end-stage renal disease (ESRD) or they're still in their Initial Enrollment Period.

For the Special Enrollment Period, your loved one should...

Start thinking about Medicare enrollment a few months before retiring.

Talk to their employer's benefits administrator about how their retiree coverage works with Medicare.

Sign up for Medicare about a month before the employer insurance coverage ends.

Ask their employer to complete the employment form.

Stop contributing to an HSA program (if applicable) 6 months before retiring to avoid a tax penalty.

It is only during Initial Enrollment and Special Enrollment that your loved one has guaranteed eligibility for a Medicare Supplement (Medigap) policy. It is only during these enrollment periods that there are NO eligibility requirements. Beyond these periods, such as during Open Enrollment (below), your loved one will have to qualify for Medicare Supplement and may not meet eligibility requirements at that point.

Exceptional situations for a Special Enrollment Period (SEP)

There are other circumstances where your loved one may be able to sign up for Medicare during a Special Enrollment Period. They may be eligible if they miss an enrollment period because of certain exceptional circumstances:

Impacted by a natural disaster or emergency

Incarceration

Employer or health plan error

Losing Medicaid coverage*

Other circumstances outside of their control that Medicare determines to be exceptional

*If your loved one recently lost Medicaid and now qualifies for Medicare, but didn't sign up for Medicare when they first became eligible, they may be able to sign up for Part A and Part B without paying a late enrollment penalty. If they already have Medicare but lost Medicaid, they also have coverage options. For more information, check out the Losing Medicaid? fact sheet.

Open Enrollment Period (OEP)

The Open Enrollment Period for Original Medicare (Parts A & B) or Medicare Advantage (Part C) is from October 15 – December 7 each year.

Each year, your loved one can change their Medicare Advantage plan (Part C) or Medicare prescription drug plan (PDP, Part D) for the following year. There are no changes your loved one can make to Original Medicare (Parts A & B).

To reiterate, during Open Enrollment, your loved one can:

Sign up for a plan

Switch plans

Leave a plan

Apply for Medicare Supplement (eligibility requirements apply)

General Enrollment Period (GEP)

The General Enrollment Period is from January 1 - March 31 each year.

If your loved one has to pay for Part A but doesn't sign up for it and/or doesn't sign up for Part B (for which they must pay premiums) during their Initial Enrollment Period, and they don't qualify for a Special Enrollment Period, they can sign up during General Enrollment. They may have to pay a higher Part A and/or Part B premium for late enrollment.

When they sign up during the General Enrollment Period, their coverage starts the first day of the month after they sign up.

RESOURCES

Understanding Medicare Enrollment Periods

What Are The Three Medicare Enrollment Periods?

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.

Likewise, no content in this app, regardless of date, should ever be used as a substitute for direct advice from a licensed insurance broker or other qualified plan-payer professional.

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

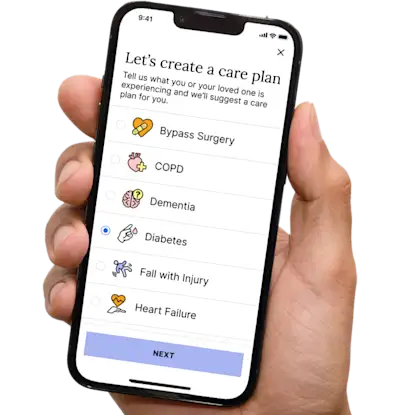

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.