Montana Medical and Financial Power of Attorney (POA) Forms

A power of attorney (POA) is a legal tool that enables your loved one to enlist help in protecting their financial, medical, and legal interests.

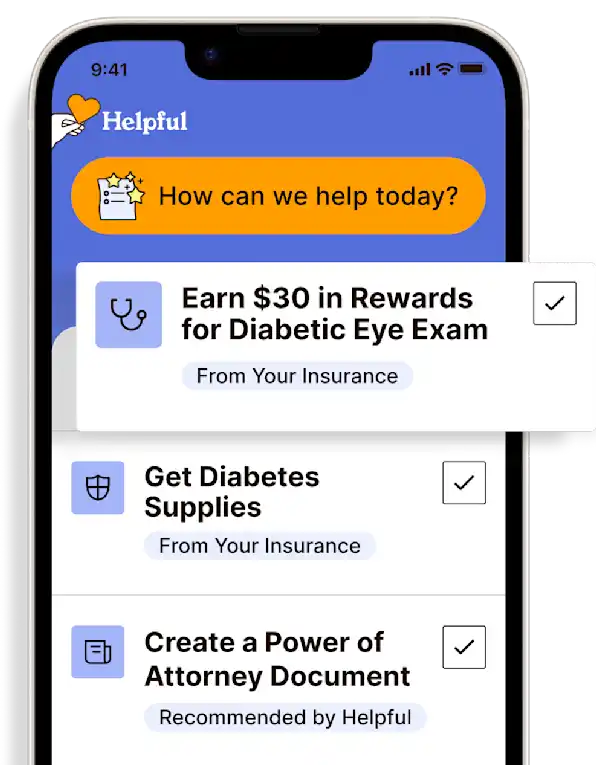

Get insurance benefits, legal documents, and medical records in one place

Helpful Highlights

It is strongly encouraged that you read the following Helpful content Guides before selecting a POA form:

Below is a limited list of Medical and Financial POA forms available in Montana.

There are many other types of POAs, such as real estate, tax, vehicle, and forms that revoke a POA.

All forms included here are free.

MONTANA

Advance Directive PLUS Medical Power of Attorney. This advance directive combines medical power of attorney and a living will that allows your loved one to define his or her end-of-life preferences, as well as choose who can make medical decisions on their behalf and select end-of-life treatment options. The person selected ensures that your loved one’s healthcare preferences are carried out when they are unconscious, incapacitated, or mentally incompetent. The form also gives instructions to medical staff on how your loved one wishes to be treated in the event of permanent incapacitation and allows for post-death decisions such as autopsy requests, organ donations, and the final disposition of the body. Requires two (2) witnesses.

Medical Power of Attorney ONLY. Also known as a Healthcare POA or healthcare proxy, this document gives your loved one the ability to appoint someone to make medical care decisions if they are unconscious, incapacitated, or mentally incompetent. The appointed person will be able to access medical records, speak to healthcare professionals, and make healthcare judgments and medical decisions based on your loved one’s treatment (or non-treatment) preferences. A Medical POA is a crucial component of advance care planning, allowing your loved one to ensure that their healthcare preferences are honored. It is important that the person selected be willing to advocate – even against opposition from others – for your loved one’s healthcare wishes. Requires two (2) witnesses.

Durable (Statutory) Power of Attorney. Grants someone else the authority to act on your loved one’s behalf in financial and legal matters. The term "durable" means that the POA remains valid even if your loved one becomes incapacitated or mentally incompetent. A Durable POA ensures that someone can manage your loved one’s affairs in such circumstances. It's important to carefully consider and clearly articulate the powers granted and to select someone capable of handling the specified responsibilities. Requires a notary public.

General (Financial) Power of Attorney. Grants someone else the authority to make financial decisions and manage financial affairs on behalf of your loved one. This document is typically used for a broad range of financial matters, and the powers granted can be extensive. Typically, this document is non-durable, meaning that the powers granted terminate if your loved one becomes incapacitated or mentally incompetent. (For powers to remain intact in these circumstances, a durability clause must be included or a Durable POA as above should be used instead.) It's essential to carefully consider and clearly articulate the powers being granted and to select someone trustworthy to handle financial affairs. The document provides flexibility for a broad range of financial matters, making it a powerful tool. Requires a notary public.

Limited Power of Attorney. Grants someone else specific and restricted authority to act on behalf of your loved one; to perform a specific task or act for a specific time period. Unlike a General POA, a limited power of attorney narrows the scope of authority, therefore it is important that the task and/or timeframe is carefully and clearly defined so as not to be interpreted more broadly or misunderstood. Limited powers of attorney are useful when your loved one needs assistance with specific tasks but does not want to grant broad authority. Requires a notary public.

RESOURCES

eForms (Electronic Forms LLC, 2023)

While the documents contained here are considered legally binding when properly executed, no content in this app, regardless of date, should ever be used as a substitute for any direct legal advice you receive from your lawyer or other qualified legal professionals.

Get more support and guidance on insurance benefits, medical records and legal forms.

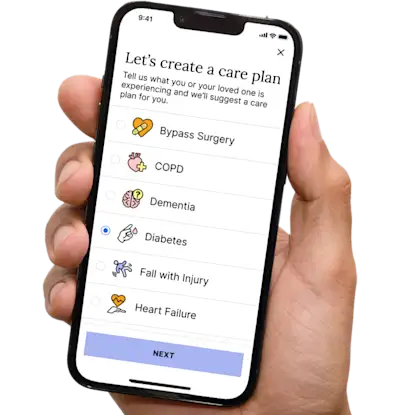

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.