Medigap Plan F: Medigap Plan F

Plan F is the most comprehensive plan and pays all out-of-pocket costs associated with Original Medicare.

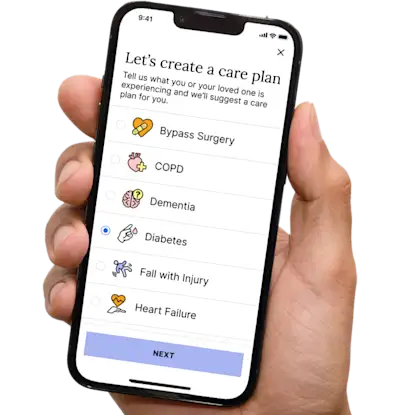

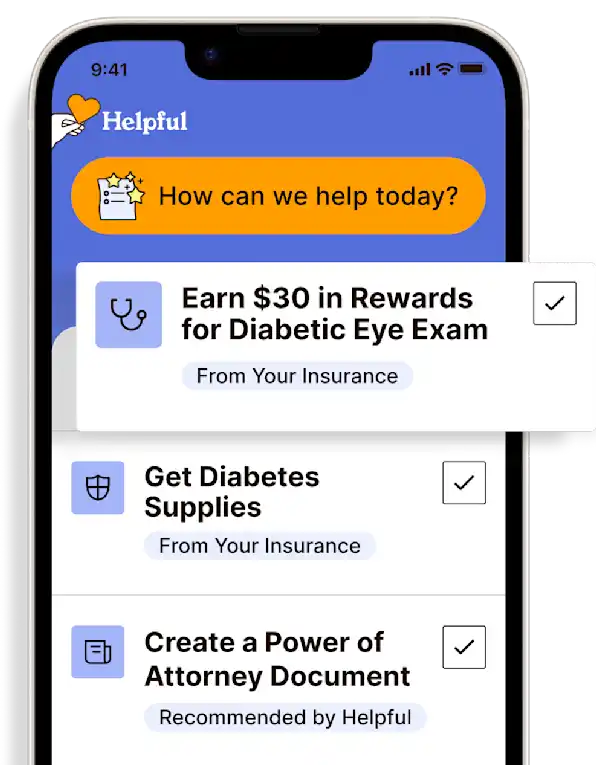

Access all my benefitsGet insurance benefits, legal documents, and medical records in one place

How To Receive

Details on how to apply

Receive services from a provider that is able to bill Medicare.

Ask that the provider bill both Medicare and Medigap.

Review any bills your loved one receives to ensure that both Medicare and Medigap have paid their portions.

If either has not paid, ask the provider to resend the bill to them.

If both have paid, but you feel that there is an error (i.e., they didn't pay as much as they should have or you have questions), contact Medicare* or the Medigap insurance provider directly.

Remit any remaining costs to the provider that were not covered by Medicare or Medigap.

*For specific billing questions and questions about claims, medical records, or expenses, log into the Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227).

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

Plan F is not available to anyone born after January 1, 1955; however, if your loved one already has Plan F, they may keep it.

Plan F is the most comprehensive plan and pays all out-of-pocket costs associated with Original Medicare. The only cost to the member is the monthly premium. No matter what the medical costs, there are no copays, coinsurance, or deductibles.

Plan F covers all remaining costs for all Original Medicare benefits: - Medicare Part A coinsurance and hospital costs - Medicare Part B copays/coinsurance - Blood (first 3 pints) - Medicare Part A hospice services - Skilled nursing facility (SNF) costs - Medicare Part A deductible - Medicare Part B deductible - Medicare Part B excess charges - 80% of foreign travel emergency

Plan F also has a high-deductible version (HD-F), wherein the deductible must be met before 100% coverage kicks in (this plan keeps the monthly premiums lower). HD-F offers all the same coverage as Plan F. The actual monthly premium depends on your loved one's age and resident state.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private