VNS Health EasyCare Plus: Flex Card ($450)

A preloaded $450 spending card for covering Dental, Hearing, and Vision items or services that exceed the health plan maximum coverage amount.

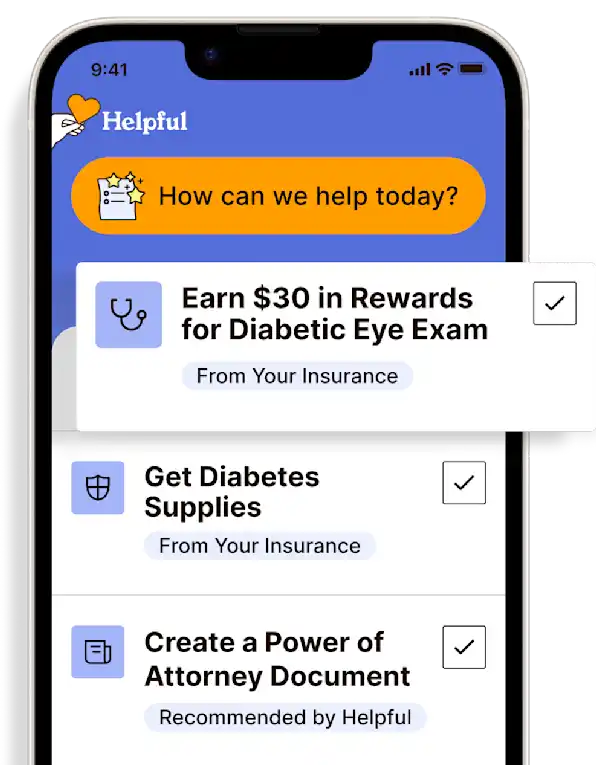

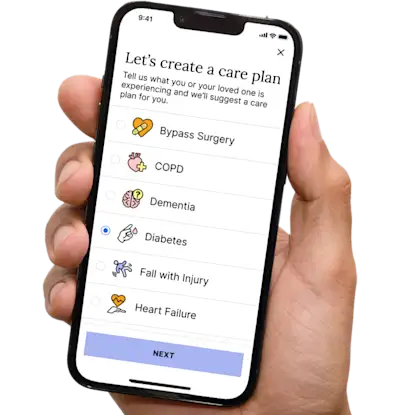

Access all my benefitsGet insurance benefits, legal documents, and medical records in one place

How To Receive

Details on how to apply

Contact the VNS Health EasyCare Plus Team at (866) 783-1444 (TTY 711) for eligibility and details.

Receive and activate the Flex Card (by calling the number on the card; follow instructions on the sticker).

Utilize the Flex Card like a credit or debit card to cover Dental, Hearing, and Vision items or services that exceed the health plan maximum coverage amount.

In the event that a Flex Card dollars reimbursement is needed, call the VNS Health EasyCare Plus Team at (866) 783-1444 (TTY: 711), M–F 8am–8pm and follow these steps:

Include member name and member ID number.

The complete address where the reimbursement should be sent.

A contact phone number.

Submit an original, itemized receipt (showing the items purchased, the store, the store location, the date of purchase, the specific name of the product(s) purchased, and the price paid) to: VNS Health, Health Plans—OTC Reimbursement, 220 E. 42nd St., New York, NY 10017, OR FAX to 1-646-524-8338

Allow up to 30 days to process the reimbursement request and a check to be mailed.

Get more support and guidance on insurance benefits, medical records and legal forms.

Helpful brings together your insurance benefits, legal documents, and medical records in one personalized place — so you always know what you have, and never have to search again.

The Flex Card is a pre-loaded debit card benefit for the year. It may be used to cover items or services that exceed the maximum coverage amount for:

Dental (Diagnostic and Restorative Dental Services; Prosthodontics, Other Maxillofacial Surgery)

Hearing (Hearing Aids - all types)

Vision (Eyeglasses - lenses and frames)

Other types of services and goods are not eligible

For example:

The member just got a pair of glasses covered by the health plan, but they get stepped on and broken.

The member is finally getting long-overdue dental work done, but the plan’s payment limit is reached before the work is finished.

A hearing aid is lost and there is a year left before the plan will pay for a replacement.

The health plan already covers a certain amount of dental, vision, and hearing items and services, but sometimes services are needed that exceed what the plan covers. With the Flex Card, the member will have extra money for those unexpected healthcare expenses. And because the unspent money on the card rolls over to the next period, the card can also be used to plan for a big-ticket expense at the end of the year.

During the first quarter of the year (January – March), a larger portion of the total card amount may be used to pay for eligible items or services. From April – December, a set monthly amount may be used to pay for eligible items or services. The card balance rolls over after each quarter and will reach the maximum allowable dollar amount by the end of the year (December), if unused.

All money on the card must be used by the end of the calendar year (January 1 through December 31). Any unused balance on the card will be returned to the plan at the end of the calendar year (after December 31) or when the member leaves the plan.

This is not a credit card. The card balance cannot be converted to cash and the card cannot be loaned to other people.

Technology for Health Tasks. Mental Health for the Tough Stuff.

Helpful connects your medical records, insurance, and caregiving tasks automatically. And when you need more than logistics, a therapist is here to guide you.

In-Network and Covered

For Individuals, Couples and Families

HIPAA Compliant, Data Stays Private

Healthcare Tasks Simplified

From syncing records to spotting drug interactions, Helpful does the heavy lifting, turning complex health info into clear tasks and showing you benefits you can actually use, giving you clarity and control over your care.

In-Network Mental Health

Our licensed therapists are here to support you and your loved ones through stress, burnout, and life’s hardest moments, with an inclusive, compassionate approach that works with most insurance plans.

Create Legal Documents

Plan ahead by creating will, trusts, advance directives and more, that ensure your wishes are honored in the event you can’t speak for yourself -with Helpful guiding you every step of the way.