Knowing how best to help your loved one, and maybe more importantly when, begins with understanding their conditions - more precisely how their conditions will progress - and familiarizing yourself with how they function today. Understanding these things serves as a guide for where they will be tomorrow (and into the future) and what they will need. All this enables you to anticipate changes and needs, getting ahead of them rather than reacting to them.

This process includes getting familiar with their various providers, especially their primary care provider (i.e., attend appointments with your loved one and ask questions).

It also means knowing their medications (dosing, purpose, side effects), allergies, and what their diagnostics (vitals, labs, imaging, etc.) indicate.

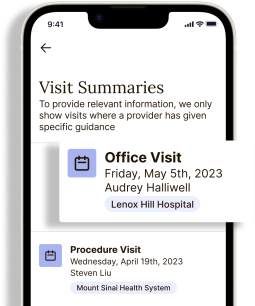

Finally, your guidebook is the treatment plan (or care plan) and its associated health goals, which are developed by your loved one and their care team. (*Note that there may be more than one care plan if your loved one sees a primary care provider and other specialists.) The treatment plan should be reviewed and updated regularly with your loved one and their care team. Oftentimes, care plans are updated during office visits and those updates are documented in an after-visit summary (AVS). The AVS is usually posted to your loved one's electronic medical record (an example is MyChart).

Along with your loved one's medical conditions and health status, it is a good idea to familiarize yourself with their insurance plan and its associated benefits. Understanding their insurance plan will help you both determine what services are needed regularly to maintain your loved one's health, well-being, and independence, what additional services are covered that can support them in their health maintenance, and keep you informed of their financial obligation (the portion of the costs they are responsible to cover). Options for coverage include:

Commercial plan, such as with an employer or pension plan (always the primary payer).

Medicare Parts A & B, also known as Original Medicare (the primary payer in the absence of a commercial plan).

Medicare Advantage plan (Part C), replaces Original Medicare.

Medicare Part D, the prescription drug plan (PDPD) required by Medicare and Medicare Advantage plans.

Medicare Supplement (Medigap), attaches to Original Medicare only and is not available with Medicare Advantage.

Medicaid (always the payer of last resort).

Or a combination of Medicare/Medicare Advantage and Medicaid.

No content in this app, regardless of date, should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician; or any direct legal advice you receive from your lawyer or other qualified legal professionals; or direct advice from a licensed insurance broker or other qualified plan-payer professional.